In preparation for New Years Eve, I just went to the grocery store. It is a sunny, 65 degree, beautiful day here in North Carolina. Life is good; God is good; all the time!

I thank you all for helping make 2004 a wonderful year. I wish the best for you and yours in 2005.

On this last day of 2004, please allow me to invite you to share your prosperity with those in need. The United Methodist Committee on Relief (UMCOR) and the Redcross are two of the participants in efforts to help the tsunamis victims. The United Methodist effort is spearheaded by the General Board of Global Ministries. Additional information can be found at http://gbgm-umc.org. Redcross information can be found at http://redcross.org. The Redcross can also be reached at 1-800-help-now.

HAPPY NEW YEAR!

Friday, December 31, 2004

HAPPY NEW YEAR!

Posted by

Jack Miller

at

12/31/2004 02:06:00 PM

0

comments

![]()

Thursday, December 30, 2004

DO THE GOOGLE GULP!

A reader, who does not know me well, was surprised when I purchased more Google at $191 per share. When I buy a stock and it goes up, I often buy more (averaging up); when I buy a stock and it goes down I study the situation all the more. If the market is up and my stock is down, I may have invested in the wrong stock. I am extremely cautious about averaging down. If I buy a loser, I am likely to take a short-term tax loss and to seek greener pastures.

My most profitable stock to date is up over 120 times since my original purchase in 1983 and I lost a fortune! Back in those days, I had not learned to average up. I made big money but, WOW!, I could have made big $$$$$$$$. (Did you notice the 8 digits?)

In the past three years I purchased EBAY six times and paid 300% more for the last shares versus the first shares. My most recent GOOG purchase was my fourth purchase and I paid $20 more per share than the previous purchase and more than $100 more per share than my first purchase.

One must take a big gulp when buying GOOG. The stock trades at better than 70 times 2004 earnings. S&P and others evaluate the stock as being worth about $190 by discounting future earnings at a 17% rate and assuming a growth rate of 90% compounded for the next three years! The term often used to describe this situation is "the stock is priced to perfection". If anything goes wrong, the stock price will fall quickly; there are lots of things that could go wrong.

My concern is not one the ones I hear the most. Many folks are concerned that one or more of the small search engines will develop an innovation that will take market share from GOOG. Another fear is that GOOG, YAHO and MSFT will outbid one another and pay too much for small companies with new technologies.

Many folks say to stay away because the whole business is over-priced or too competitive or they recommend buying the little guys hoping for a brilliant new app or a takeover. The first position could easily turn-out to be right in the near to intermediate term, but I believe the second position is clearly a losers game. How many times does the market have to prove that ones best odds are to buy the market leaders? Huge fortunes have been made buying one or two good stocks and holding on. Huge amounts have been frittered away trying to find an underdog to take out the king; most of the time the king is just to powerful to be overthrown.

Look at it this way; how would you like to run a business competing head to head against GOOG, YAHO and MSFT? These firms have money, relationships and skills that will allow them to run the little guys out of town.

It is amazing how many things one can already Google and there are many more to come. In our office, a day doesn't pass unless someone asks a question and the reply will be, "Google it". Even AMZN and EBAY have some risk of being passed over by search engines. One option may be to google or yahoo search for a used copy of grapes of wrath for under $5. The results may show an AMZN best price, an EBAY best price and Joe Smith's best price. If the Google search box is present on your desk-top or on most web sites, many may not bother to open their EBAY account to do a search? In the same way, if your browser has MSFT search built-in, one may not bother to Google.

By the way, Craig's List (19% owned by EBAY) has built a commanding position in classified employment ads and is hammering the newspaper business. Why pay the LA Times $750 when you can get better coverage for $75? EBAY just paid big money for Rent.com and seeks to take over the residential rental market.

EBAY has had a lock on auctions because of the scale they so quickly achieved. When anyone wants to find an item for sale, they know EBAY is likely to have it. GOOG has the same kind of scale in search. There are other search engines but GOOG has a loyal following and the GOOG search engine is still the best.

The risk, apparent to us all, is from MSFT. It is not news that the Windows platform gives MSFT a super competitive advantage. Netscape, Lotus, Quicken, and many other large companies have been sliced and diced by the power of owning the platform or from the seemingly limitless capital MSFT can throw at a market segment. It is not news that MSFT has introduced a new search engine or that the search engine includes Encarta as a bonus feature. It is not news that MSFT will eventually have spidered just as many sites as GOOG. It is not news that MSFT has been working on the next version of Windows for several years. And, it is not news that the next version will embed MSFT search into the built in Explorer Browser. Because FoxFire has GOOG embedded, MSFT may even introduce a browser upgrade before Long Horn is released.

There really is no news big enough to sway ones decision to purchase GOOG at current prices. I simply keep buying GOOG because I believe it will survive as number one or number two in the search business and I believe the search business will become extremely large. I believe in the GOOG model which means that I believe GOOG can continue to make money by offering many free services in exchange for advertisement space. The one-man shop and the monster business needs GOOG and receives real value from GOOG because of the ease of putting relevant advertising in front of the exact number of customers the business can handle.

Libraries are big but are currently being reduced to the size of your pocket computer (cell phone, PDA, game machine, lap-top). Video and radio are two more areas yet to be catalogued. Blogs are relatively new but billions of people will one day post to multiple on-line "diaries, calendars or communication ports". On-line schools, conferences and meetings may be sponsored exclusively by advertisements. The number of adds to be displayed on emails will become a very large number. We are at the start of a process that will take years to mature.

If you buy GOOG today and tomorrow MSFT announces a new browser with search embedded, GOOG may drop 25 points or more immediately. If MSFT rolls out Long Horn (Windows version X.X) and if Long Horn has many "anti GOOG" features GOOG could drop even more. On the other hand, if the 4th quarter report turns out to be as strong as I think it might, GOOG could go up 10, 20 or more points in a day. In fact, since over 10% of the total float is currently sold short, the pop could be very large.

Although the stock may have partially discounted some of the facts and rumors yesterday and today, it is amazing how much retailers paid for certain search phrases in the final few days before Christmas. Some key words fetched $10 or even $20 per click! Even AMZN got in on the game. AMZN reportedly dramatically increased its average ticket size by key word targeting digital cameras and other hot electronic products. In the past couple of months, lawyers paid dearly for Vioxx and Celebrex in the hopes of meeting up with potential million dollar litigants.

GOOG has been a volatile stock and will continue to be volatility for some time. It is foolish to try to play the stock short-term. It may move against you quickly no matter which side you take. The biggest mistakes I have made in the market have been to sell winners only to watch them zoom for years thereafter. How many of us made good money on a relatively short-term DELL trade? How many of us bought DELL early and made 8,000% in five years? The GOOG key is to decide if you believe the story or not. If the decision is yes, do the gulp and hang on for the ride.

My decision is to DO THE GOOGLE GULP! Hard decisions are almost always the most profitable ones. Just a few weeks ago, it was hard to buy CAL (Continental Airlines) when the airline news was absolutely terrible. Just a week or so ago, it was hard to put in a market order to buy PFE (Pfizer) with the stock indicating down $4 on the opening. Right now, $23.52 PFE looks great and $8 CAL looks fantastic.

Please keep in mind that the difficulty of making tough decisions is reduced through good portfolio management. My families total ownership of GOOG is a relatively small portion of our net worth. No one stock should start out at more than 7% of your total portfolio value. The exception might be the young person who has discretionary income and who is committed to building a portfolio over time using dollar cost averaging and time cost averaging techniques.

Buy through BrownCo and spend only $5 on the trade!

There is no charge to have this amateur review your portfolio!

This was written for entertainment and educational purposes only!

I write for you in the hope that you will be kind enough to refer me to your friends!

Posted by

Jack Miller

at

12/30/2004 04:00:00 PM

0

comments

![]()

TRUCKING WILL KEEP ON TRUCKING!

Trucking stocks and rail stocks were good stocks to own this year. Not withstanding the fact that most had pretty big down moves during the spring and summer. Fortunately, we held on and even bought more of SCST. SCST in particular ran up too fast, gapped down and finished strong. CSX did alright and YELL went from 37 to 57. We added NSC to a few accounts late in the year and are up 4 to 6% on those. Why is transportation so strong? Will it continue to be strong?

The process of rationalizing the business took 30 years or more. Thirty years ago, railroad contracts were based on "the old days". Every train had to carry several employees and in many cases the employees were paid a full days pay for every 100 miles of travel. Now-a-days, trains leave the Florida farms in the evening and arrive in NY the next morning. Twelve days pay for a one night trip! NO! The rails knocked some heads and reached better labor contracts 30 years ago. Gradual attrition was used to lower the workforce until the late 90's and finally layoffs and spin-offs were used to down-size excess middle management.

In recent years, the rails divested short-lines, added equipment to improve turn times and added enhanced data and communication technologies. Shipments now transfer from ships to rail to trucks efficiently. The combined effect of all the above means operating ratios are the best in centuries.

The increased demand for coal and other bulk commodities has also been a significant benefit to the rails. NSC for example is hauling long coal trains at peak operating rates. Rail capacity has been pushed to the point that truckers have been able to pick up business based on better service not better price.

Ironically, as the baby boomers retire, it is the shortage of labor that is helping the industry the most. If you want to earn a good living, sign on as an engineer trainee. If you are willing to be away from home nights and weekends, you can earn $110,000 per year "sitting in a rocking chair". The key fact is that trucks and trains need to run at full loads because they can't find another driver to make another run. The $110,000 wage is extremely small when compared to the total revenue generated.

Often times we forget how simple business is. When your business is running at peak capacity at high margins, you make a lot of money. Because the stock market looks ahead at least 6 months, the stock prices are currently discounting the good profits projected for next year. However, when an industry is in such a sweet spot, it often takes a long time for competition to materialize and high margins can last for several years. In the case of hauling coal, we are talking about a very long process. In many cases, there will never be another competitor hauling coal from certain mines to certain power plants. The competition must eventually come from a cheaper electricity produced at another power plant! World wide demand for energy is growing quickly. Hauling coal will be a strong businesses until major new sources of energy are developed.

The bottom line is that it took years to get to this very profitable scenario and it will take at least until the next big recession to slow the profit down. For the next several years, TRUCKING WILL KEEP ON TRUCKING!

Posted by

Jack Miller

at

12/30/2004 11:28:00 AM

0

comments

![]()

Wednesday, December 29, 2004

BEATING THE SAME DRUMS!

I hate to beat the same drums but, when it is time to make money, it often requires more than one push to get the majority to catch-on. When the majority finally does move-in, markets quickly move to the bigger fool stage. MER, ET and other brokerage companies are doing well after reports that the public is finally beginning to come back to the market.

We are a long way from the public committing to "all in". When they do, in the bigger fool stage, it will be wise to make sure you are not one of the last ones at the party. By diversifying ones portfolio and moving to the best values offered, one should stay in the game continuously. There are times to be aggressive toward stocks, bonds or cash but even the cash investor is participating in the game if he is in cash for solid and rational reasons. Clearly the time to be most aggressive toward stocks was in October two years ago, but the bull market is not over. There may be some stocks that have entered the bigger fool stage. Perhaps SIRI, EBAY and GOOG are among them. Never-the-less, one should stay aggressive toward stocks. The trick now is to pick the right stocks.

I have put serious money into big US companies of late. However, I continue to mix in a few turn-around plays and high flyers and naturally most of the talk is about the turn-around plays or high flyers. In a new monitored account a couple of years or so back, we purchased Goodyear Tire as our first core position. We did not have the money to diversify the account but we made a plan to dollar-cost average by buying 14 other stocks as funds came available. The GT was an excellent first pick and is up about 300%. Our second pick TXN is up about 10%. Today we added equal weights of TIVO and GOOG; not picks for your Grandma.

Peter Thiel, the founder of PayPal, is working as a stock analyst now. He is a stock market bear. His focus is on all the problems of the world including the declining dollar. He mentions EBAY and GOOG as being over-priced having discounted perfection. He is a smart man but EBAY and GOOG are among my top holdings and barring a major disruption in the businesses, I intend to hold long-term. Ebay is up another couple of bucks today!

The monitored account mentioned belongs to a young person who wants to hit home runs. In fact, her goal is to win at least one "world series" (the world series is making 100 times your money on one stock). Goodyear is off to a good start as a 3 bagger and as a cyclical pick is unlikely to be more than a 10 bagger. GOOG is selling at a high price but has the market really discounted all the potential? How can anyone know the potential of this new world of wireless broadband that we are entering? TIVO is on the cutting edge of our rapidly developing "new TV" market. The "big boys" keep working around TIVO but TIVO owns some significant patents and it may come down to a choice between a TIVO system or a MSFT system. To compete, TIVO will need capital and bigger company may take the plunge. TIVO could lose out totally or it could be very big; the only middle ground on this one is a buy out at a low premium.

This young person would like to own GOOG and TIVO 30 years from now if indeed they continue to be the innovators in the market. A few bumps, even large ones, along the road will not matter.

Our TYCO is doing very well. "Cuzzin Bill" put us on to this one. JP Morgan over-weights it and just moved the target price to $40.

The news from FON/NXTL and TWX this morning was anticipated in my earlier posts. FON/NXTL is onto a neat way to build market share quickly. TWX will try the concept of offering cell phones branded as TWX service. FON/NXTL will sell the air-time to TWX at wholesale prices. TWX can easily insert a flyer in a cable bill, offer a discount for a "total package of services" and occasionally virtually lock in a customer. It is one thing to switch from cable to satellite TV but a real pain to change one's email address, phone number and buy new cell phone equipment.

The trial will take place in Kansas. As reported earlier, ESPN, Quest, AT&T, and others (probably Disney) are preparing similar services. ESPN signed in order to add distribution for short sports TV segments over cell phones. TWX is looking for additional distribution channels for its music, video and internet offerings. FON/NXTL may trade TWX service for content. The rumor is that Disney sees a new profit center though cell phone animations.

The above reminds me of a cell tower lease of my families land. What a clean transaction? On adjacent property, the family owns commercial buildings that must be leased, maintained and managed. The commercial buildings are profitable but a lot of work. The cell tower is no work at all; once a month the check is deposited directly in the bank. The cell phone companies do all the work but the family participates in the business. After the first lease was in place, another company added equipment to the same tower and they send another check! FON has already built the towers, why not let TWX help pay for them?

FON and NXTL are in competition with VZ and Cingular. All three companies want solid coverage through-out the country. Although it will take a couple of years for FON and NXTL to merge their networks, the total area covered by the two companies is more than the area covered by either. Even though ESPN, AT&T and TWX will over-lap the same coverage areas as FON/NXTL, they will buy mostly spare capacity! This is smart! It is using resources wisely! FON/NXTL will increase the utilization of the current network and be able to build-out places that would be un-profitable for the single company.

As indicated in earlier postings, the big cable companies have no incentive to partner with VZ or Cingular. The fit with FON/NXTL is a win-win. Look for Cox, Comcast or both to announce a similar deal. This market is competitive and requires billions in capital spending but the growth has just started. TV, Music, Video and an internet that we would not even recognize will be available through the coming high speed networks.

An interesting little sideline is that Microsoft continues to get widows SIP software installed in more devices. For example, the X-Box game machines support SIP. Gamers from around the world are able to talk to one another while competing. The voice and data traffic are being carried over the Level Three network. In my monitored accounts, we have one small position in LVLT. This is a speculation on VOIP and high volumes of video traffic. We also own T. Each of these stocks are out of favor but they both are ready to carry much larger volumes of voice and data. Much larger volumes of voice and data are coming. Voice requires only a small fraction of the bandwidth required by video.

The oil inventory draw down was in line with expectations this morning. The coming elections and insurgent activity in Iraq continue to cloud the forecast for oil prices. Oil normally bottoms in the winter. Gasoline demand drives the price in the summer. At least a couple of the sell side brokers call for prices to rise again next summer.

The normal business cycle suggest that now is the time to rotate out of oil and into consumer staples and health care. We bought a chunk of PFE at $23.52 and of course wish that we had bought more. It is trading above $27 today; MRK (which we do not own) is over $32. Our purchases of PEP, WMT and others are doing o.k. Long-term demand suggests that oil companies will continue to enjoy large profit margins until some major new sources of fuel come on-line. The rig count is high and places like Tripoli are busy. My accounts are under-weight in energy. Some of the proceeds from PFST may go into energy. We participate indirectly in the coal markets through ownership in the railroads.

Did my posting move the market? Nah! It is still fun to know that I posted that industrial metals are over-priced yesterday and then see the price of Gold drop $4 today while the dollar fell to new lows. I see the past few days of dollar/gold action as an interesting divergence. The increases in short rates may actually be having an effect. The dollar may be bottoming out and Gold may have already peaked. The dollar dropped in over-seas trading but bounced this morning. At the very least, the dollar is running into some pretty strong support.

Our RBK is on a pretty strong run. The unfortunate Sunami problem may actually boost the profit margins for a time. I am not sure but I believe the reduction in tariffs should increase the importation of RBK shoes to America. I plan to take another look at this long-term holding.

Please remember to keep your transaction costs and taxes low and to diversify. Remember that the best places to invest are not being discussed in the news media. The news focus is on what is hot. I am a news hound and therefore likely to get caught in the "news trap". I have to work at making sure I hold contrary positions. I would be happy to review your holdings. As an amateur, I cannot charge you a fee or make any recommendations. I can tell you what I think and it is up to you to decide the best course; just as it should be. Do you hear the drums?

Posted by

Jack Miller

at

12/29/2004 10:18:00 AM

0

comments

![]()

Tuesday, December 28, 2004

BONDS ARE CHEAP? STOCKS ARE CHEAP!

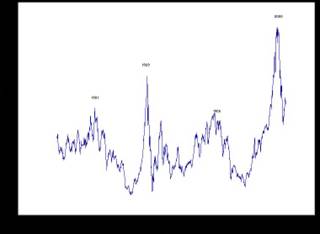

BONDS ARE CHEAP? (click on image to enlarge)

The above chart of the 30 year bond price relative to industrial metals prices, shows that BONDS ARE CHEAP! Yes I am a bond bear and yes BONDS ARE CHEAP!

The chart tells the story. Each of the bottoms shown on the chart above were wonderful times to buy bonds. The two lows back in 96 and 97 were also wonderful times to buy stocks. Another fact is that each of the prior lows in this chart were terrible times to buy industrial metals.

When the economy comes off a recession, it takes a while for the mines to catch up. In the early stages of the recovery, companies will buy metals at any price as there are profits to be made. When the mines catch up, the price of the metals settle back to a function of what it cost to mine them versus a price based on a short supply.

The chart below shows that the SPX has been cut in half since 1999 relative to industrial metals. This is a huge cut because over the long haul commodity prices go down. I know a lot of you do not believe that commodity prices go down and I am not going to produce a chart to prove my point here. If you don't believe it, do a little homework and then reply with a comment.

Right now, a lot of folks are afraid that inflation is about to jump because of the decline in the dollar. The fact is that a decline in the dollar is not inflationary. Yes the price of gold and foreign made goods may cost more in terms of dollars but this is simply a function of the terms of trade.

The key point here is that the charts show that interest rates are not ready to take off to the moon but if anything industrial metals prices are about to decline. The decline in metals prices will be the opposite of inflation. The increase of cheap textiles coming to America is also a dis-inflationary input.

The above factors will to some degree offset the price pressures induced by strong economic growth. The result is a sweet spot for stocks; moderate inflation, moderate interest rates, high productivity and strong revenue and profit growth. For some time, it has been my belief that one should avoid bonds not so much because bonds will lose value but because stocks will gain so much value.

Ken Fisher has written about the coming melt up. If bonds do indeed rally from here, can you imagine the amount of money that will look for a home in high yield stocks that pay dividends that are 85% income tax free? The market always presents two risks. One is that if you buy stocks they may go down. The other is that if you don't buy stocks they may go up. Right now the risks of being out of the market appear to be greater than being in the market.

Posted by

Jack Miller

at

12/28/2004 06:46:00 PM

0

comments

![]()

CALM SEAS, FAIR WEATHER, GOOD WIND!

The environment for stocks can't get much better. Core Consumer Price Inflation is rising but is still only slightly above 2%. The Fed Fund Rate has increased 4 months in a row but is only at 2.25%. Housing demand is strong, continuing unemployment claims are dropping and labor earnings are soaring. Consumer confidence is high. The world wide business slow-down is coming to the end. China is pulling hard on the reins to slow things down and will only grow at about 7.5% this year!

The fear of terrorism, fear of oil supply disruptions and fear of being flooded with low priced textile imports are all still present and tending to hold stocks below fair value. Market mavens are typically predicting moderate stock returns for 2005 while predicting earnings gains of 11% or better.

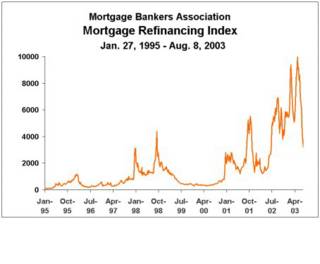

Perhaps there is too much complacency but the good news is that the good news hardly gets reported. News reporters are likely to ask if the oil price is going to go back up or is housing the next bubble. For two years, housing has been seen as the next bubble. While I do not recommend that one purchase residential rental properties at the current time, housing demand is quite strong. Mortgage application indexes are quite strong. The refinance index has dropped because most have already refinanced at low rates. Apartments are experiencing vacancies because the former tenets have purchased a home. A friend of mine recently reduced his house payment by $450 per month and is enjoying financial and emotional relief.

The Big Picture Looks Great! What is new?

Yesterday, I mentioned that AMZN had a great season. The positive numbers showed that, for the first time, AMZN had higher consumer electronics sales than book sales. AMZN sold one half million gift certificates! Search statistics show that the Internet Movie Data Base (owned by AMZN) was one of the most popular sites. This is a wonderful site for reading reviews. A few companies sell movie tickets on-line; this is another ripe area for AMZN to enter. AMZN has started a Netflix style service in Europe. The purchase of NFLX by AMZN would give AMZN 2.5 million new customers, local distribution centers and it would all tie in nicely with its movie data base. Blockbuster is tendering for Hollywood shares. Does the movie rental store survive as a viable business model?

As you might expect, after the 9% move yesterday, Bear Sterns upgraded AMZN. The stock is up again today and Bear has a target of $55. The big negative is that Wal-Mart and other retailers are figuring out how to sell on the internet. Wal-Mart is a leader in internet traffic. Since I have both stocks in my portfolios, I am biased. I believe they can both continue to take market share. The losers will continue to be the smaller retailers that cannot match these big guys on price or the closing of stores like Toys are Us and video rental stores.

BankAmerica raised its target price on SIRI to $5.25. BA still has a sell on the stock. VOD and FON have each started cell phone music services. It is widely anticipated that APPLE will announce its deal with Motorola January 10th. The new phone will not have a hard drive but will down-load i-tunes to flash memory. Drives continue to come down in size and you can bet your boots that most phones will offer TV and Radio in two or three years.

A major point to remember is that the need for the super large drive goes down each time the transmission speed goes up. Now-a-days, you can store your pictures on-line with Picasa, your diary with Blogspot, and a gigabyte of files, address books and email with Gmail (all of these are Google products but you can find competitors to offer the same services).

Third generation speeds are rolling out now and which will be slow in a few years. We are still in the horse and buggy phase. China now has the fastest internet service! Standards are already being set for the day when the old analog TV spectrum comes available. When all TV goes digital, there will be a tremendous amount of spectrum available for other purposes. Broadband wireless Internet Access will become ubiquitous. With a very fast wireless connection, you will always have access to voice, data, video, storage and many totally new services. Don't dread the day, embrace it and make money off of it!

The reason AOL has joined the party offering free web mail, is because web mail is a "sticky application". Once a consumer gives out his email address, it is a lot of work to let everyone know of the change. Redirect service may be available but it is like your phone number; you do not want to change unless you must.

I am anxious to see the email numbers. I suspect that Gmail is getting a good percentage of new addresses. A free service that offers search and other capabilities is hard to beat. I still use my Road Runner address but anticipate going exclusively to Gmail in 2005.

Comcast has had a good run recently; there was a positive article in Barrons this week. The Japan ETF, EWJ has moved up nicely. Liberty Media, TIVO, GNTX, AHG, YELL, PFE, ETRS, and ADBE are all doing very well. The list of good performers is quite long. AMX, TPX, CCJ, ADM, ET, EBAY and others are at or near 52 week or longer term highs. Even the real big slow movers like GE, FLR, GSK and PEP are gradually making headway. GT continues to maintain its status as one of our top holdings. At $14 a share, I have the same fondness for the stock as I had at $5.00 per share; it has a long way to go. In calm seas and fair weather, it is amazing how far you can go if you have a good wind!

Posted by

Jack Miller

at

12/28/2004 10:41:00 AM

0

comments

![]()

Monday, December 27, 2004

BUY BIG STOCKS--NOT LITTLE!

SPX VERSUS SPX EQUAL WEIGHT (click on image to enlarge)

One of the portfolio managers I respect and with whom I frequently agree is Roger Nusbaum. He and I consider the shape of the bond market yield curve as the most important consideration before investing in stocks. Roger recently posted a chart similar to the one above and indicated that he believes the equal weighted index will continue to out-perform the S&P 500 index.

In the equal weighted index the performance of small stocks effects the overall performance just as much as the performance of large stocks. In other words, when Roger indicates that the SPXEW will out-perform the SPX he is in essence saying that small stocks will out-perform large ones.

Numerous studies by Ibbotson, Shaunassey and others have shown that small stocks do indeed out-perform large stocks. Other studies have shown that humans are unique among the animals in that even when we know the probability of success is highest in one area, we cannot resist trying other areas. In other words, if you teach a pigeon to get food by pecking a green or a red light and if it takes 10 pecks on the green light on average to get food but only 7 pecks on the red light, the pigeon in no time at all will peck only the red light. The human will push the red light most of the time but sooner or later he will get bored with it and will push the green light a series or two just to see if the rule still holds. The human will never stop checking out the green light.

A portfolio manager with the discipline of the pigeon, would only buy small stocks. He would not ever try to "out-guess" the market. With a balanced portfolio of small stocks, he would make healthy returns over time. He would not have a lot of fun and his customers would wonder why he is needed but the accounts would do well.

Besides, in the markets, rules do change. At least for long periods of time, when it really is "different this time". And, it is always true that two people can look at the same chart and draw different conclusions; this is such a situation.

It is my opinion that 2005 will be a year similar to 1995. As you can see in the chart, large stocks barely out-performing small stocks in 1995 but in each of the following several years the performance was better and better until well after the peak in 2000. The Russell small stock index has done extremely well since October 2002 as has emerging market stocks.

To out-perform the market one needs to zig when others zag. Data show that mutual fund money is flowing heavily into emerging market and small stock funds. As a contrarian, I say, now is the time to buy into developed country stocks such as Japan, Germany and the US. It is time to buy big versus small and value versus growth.

For the past several weeks, I have written that I am buying the "big, dumb and uglies". I have not done so exclusively. For example, I purchased shares in Gemstar (TV-Guide) and Real Networks. However, most recent purchases have included, PFE, WMT, PEP, and CAL. I also added to AMZN and GOOG in the past couple of months. Granted AMZN and GOOG are not value stocks but they are certainly on the big side. Take-overs took me out of AWE, PFST, and MKWT and I voluntarily cleared out of SIRI and XMSR. I took the biggest gains in SIRI and XMSR; these were tough to sell but it was tough to hold these high flyers.

Time will tell which groups will do the best. The key is to invest in stocks. Interest rates may not go up a lot this year but any increase will take away from bond yields. Note: I am not advocating a massive portfolio shift. Hold your winners but buy big with new money.

Posted by

Jack Miller

at

12/27/2004 10:01:00 PM

0

comments

![]()

VOLATILITY INDEX--MUCH TO DO ABOUT NOTHING?

VOX--MUCH TO DO ABOUT NOTHING? (click on image to enlarge)

One of the CNBC anchors has recently expressed concern about the complacency in the market as evidenced by the VOX index. This concern was echoed in "THE BIG PICTURE" blog that I enjoy.

The VOX is followed by active traders and is an indication of option activity. Most folks use it as a contrarian indicator. When the activity hits a high level, traders assume speculators have pushed the market too high. Study the charts above and chart below and you will see that the peaks in the VOX correlate well to inflexion points in the S&P 500. On the other hand, note that the market does not change direction near the bottoms or there is al least less correlation to the timing of moves.

In my experience, really good active traders are right only about 50% of the time and make money only because they hold winners longer than losers. For most investors, active trading is a futile enterprise. We simply do not have time to watch every indicator and it is easy to get eaten alive by excessive brokerage commissions and taxes.

When the index zooms to an extremely high level, I do pay heed! However, a low level of activity can easily be interpreted incorrectly. Notice that the index was at an extreme low in January 1995 and notice that the S&P 500 did extremely well in the years following this extreme low.

I seek to hold stocks for an average of 4 years or more and I like to cut my losers short. To reach my average, I must hold some stocks for 10 years or more. The next recession will be a real estate recession and real estate recessions are typically pretty rough (1973-74 and 1990-91). The next one should occur in about 5 years. In the mean-time, many stocks will do well.

You and I should focus on finding several good stocks to own for the next several years. We do not need to worry about how excited the option traders are at any given moment. They can be super bears and super bulls within the same few months or even weeks.

Today, the price of oil and the US dollar plunged while interest rates increased. In recent weeks, each decline in oil has been paralled by a rise in the market. Today, the increase in rates and the decline in XOM and other oils were a drag on the market. Airlines have been soaring with each decline in oil but the debacles during the holidays did not help the airlines. Still, CAL was up again today and I am up about 50% in just a few weeks. I am breaking even on the DAL purchased a week or so ago. I added to AMZN only a few weeks ago and today AMZN was a top performer, up about 9%. On-line retail sales are growing at 25%+ per year!

Corporations have $650 billion in cash on their balance sheets. Stock buy-backs and take-overs permeates every industry. Tomorrow the tender for Peoplesoft will go through giving my accounts cash to invest. I have several stocks in mind. The point is that I intend to re-invest quickly. I want to own another stock before that company or another company decides to buy the stock.

In the past several months, my accounts have had several take-overs. These all occurred while the VOX was low and falling lower. I simply cannot sit around worrying about the lack of volatility in the options market. The time to make money is always during a time when folks are worried about something. The concerns about the VOX are MUCH TO DO ABOUT NOTHING!

Posted by

Jack Miller

at

12/27/2004 08:01:00 PM

0

comments

![]()

S&P 500 DID WELL AFTER THE 95 LOW IN VOX!

Posted by

Jack Miller

at

12/27/2004 08:00:00 PM

0

comments

![]()

Friday, December 24, 2004

THE LOVE OF DAD!

Dad passed away this year. He would have been 84 in October. He left behind his loving wife of 60 years, 5 children, 4 son and daughter-in-laws, 12 grandchildren, 7 grandson and granddaughter-in-laws, and 3 greatgrands. He was preceded in death by his "favorite son-in-law", Russell Blackburn.

This blog is about stocks and bonds and Dad invested in stocks, bonds and real estate. He made his serious money in real estate. His most important investment was the purchase of 22 acres in 1966 near the Clemmons NC interstate 40 exit. The land was a farm on a dirt road and the seller insisted on a small down-payment and 5% interest on the balance over 10 years. Dad said that it is every man's dream to own 10 acres, 10 miles from town, on the interstate. In hind sight, it looks like an easy decision but like all great investments, it typically takes a combination of vision and common sense to make the right choice.

When I was 11, 12 and 13 years old, Dad took me downtown to watch the stock market ticker tape at the old Harris Upham office. There were always old men there watching the tape. They pretended to know who was buying and who was selling the heavy activitiy in a certain stock. Watching the tape was an enjoyable past-time for these old guys. I love to watch the tape to this day.

Dad had a healthy skepticism about the motivations of brokers and brokerage firms and liked to make his own decisions. For years, he used drafting tools to draw chart patterns and then for years he subscribed to Daily Graphs or an Options Chartbook. He never cared a lot about fundamental investing. One of the things he taught me about the market is that it is like steering a battleship. He believe that once a captain gets a battleship headed in a certain direction, it is going to continue to go in a direction for a good distance and there is no reason to get in its way. He said the captain may tack back and forth across the wind but he was not likely to turn around until the trip was made.

When Dad was 79 years old, he purchased a computer, learned how to use it and learned how to trade stocks on-line. He certainly was not afraid to seek out new ideas or to try new things. Reviewing his accounts and making frequent trades at discounted commissions was a past-time that he enjoyed immensely. Ironically, even though I learned a lot from him, I developed a very different investment philosophy and I often disagreed with his investment decisions. He and I had to be careful when discussing investments because it was easy for us to get into an argument.

In truth, in my humble and honest opinion he was not terribly successful in the stock market. He purchased several very good winners during his life and held several excellent stocks for long periods of time, but he also bought a lot of turn-around plays, stocks that looked cheap, only to see them go down more. He was far more likely to average-down than to average-up. He enjoyed trading options and really did not want to hear my opinion that no one is likely to make consistently good returns trading options. Just like he would have done, I let him know my opinion anyway.

As a patriotic American, he purchased savings bonds for his grandchildren. Once again, I made the mistake of telling him that there are better investments available. He thought I was half crazy when I went on margin to buy treasury bonds when yields were high. It didn't matter that I made money. He believed that one should avoid borrowing money if at all possible. He saw bonds as savings instruments for children and old people. He never got old and he kept his investments in stocks and real estate.

I suppose the most important investment trait he and I needed to improve upon was patience. I have become a more patient investor over the years but he and I were always restless and excitable. Like so many others, we always liked to make a quick dollar and move on to the next trade. The good news is that my children own stocks that they have held for several years and that have done very well. They have learned that it is time in the good investment rather than timing the good investment that makes the serious bucks. The other good news is that Dad made a lot more money than most during his life time, left his wife and children with solid real estate holdings and enjoyed the past time of trading stocks.

Tom Brokaw wrote about the greatest generation and Dad could have been his perfect example. You have all heard the many stories about depression era tough times. Dad was literally one of those who earned 10 cents per day working long hours in the tobacco fields. Before long, Dad was making 2 cents more per day than the other workers because he was willing to take care of the mules and to turn the sleds around at the end of the rows while the other workers caught a quick break.

Dad had nine brothers and sisters who never went hungry. When a neighbor visited, there was always an extra glass of lemonade because Dad's Mom, Beatrice Reavis Miller, could squeeze just a little bit more juice out of the lemon.

Dad was a world traveler who visited every state in the US and at least 50 other countries. He graduated high school in 1937 and immediately left the family farm to join the navy. In six years of service, he was promoted through the enlisted ranks to Chief Warrant Officer. He was one of those un-sung heroes that saw more war than anyone wanted to see. When pushed to talk about the war, he could tell incredible stories but he really did not like to bring up the memories. When it was done it was over and he came back home to raise a family with his childhood sweetheart, Mary Lou Reavis.

Dad valued the education he received during his Navy years but he was a farmer at heart. He and Mom used six years of savings as down-payment on a farm and proceeded to do what farmers do; grow crops and kids. When it became obvious that a small post-war farm would not support a family of seven, Dad helped Mom farm during the day and took a night job with the Western Electric division of AT&T.

Mom taught school, farmed and looked after the kids while Dad worked his way-up through the ranks at Western Electric. Mom and Dad sacrificed, saved, invested, gave to the church and the needy, sold the farm, moved to town and enjoyed seeing all five kids graduate from college. The fact that they sold the farm does not mean that they quit their second jobs. While Mom was likely to can vegetables to save a few dollars, Dad was always working to make a few extra. He sold everything from cookware to burial plots. He and Mom always raised a garden if not milk cows, beef cows or even a big old hog. They built workshops on the 22 acres, and rented them out to various small businesses. When it was time to paint or repair, they were there.

Dad retired from Western Electric at 56 years of age to travel, but he continued to work very hard as he had always done. In retirement, he was everything from a waiter in the New Orleans French Quarter to a vendor on the boardwalk at Myrtle Beach. A few months before his death, my brother and I could do nothing but laugh when we found him sawing down a tree one afternoon after he had gone for cancer treatments in the morning. My brothers nor I were ever able to out-work him.

O.K. now that you know a little about Dad it is time to explain the title. As you have read, Dad was a busy man. The casual observer might think that he did not have the time to show a lot of love. He could be so focused on a task that his family knew better than to bother him. He could snort, fuss and yell with the best and his words could even bite. At the age of 13, I could tell if the stock market had gone up or down when I heard his footsteps coming though our back door. Dad went all out, heart, mind and soul, to succeed. When things did not go particularly well, a foul mood could come over him. His solution was to simply work it off.

My brothers, sisters and I lived in a nice house, wore good clothes and rode in nice cars but sometimes we felt a little poor because we did not have money to waste. The neighborhood kids bought sodas, candy or marbles but we had homemade butter, blackberry jelly and fresh milk for snacks (we didn't have the sense to know that there is nothing better than homemade butter, blackberry jelly and fresh milk). We learned to win the other kids marbles in a fair contest and then sell them back to them cheaper than the store price.

Mom and Dad looked after us but they also expected us to look after ourselves. It was no big deal for me to walk to and from scouts or to walk home after basketball or football practice. My older sister helped run the house at young age and each child got a turn or two spending the summer with Grandma and Grandpa so we could work in the tobacco fields.

The casual observer would have been mistaken. Dad did take the time to express his love, he just did it differently. Keeping the promises he made was an act of love. The high value he put on education caused him to promise all 5 kids that he would pay for their education no matter how long they went to school. He threw in the stipulation that his payments ended when each child married. Another promise he made was that he would have a car sitting in the driveway on a Friday or Saturday night for us to use when we got old enough to drive.

Dad did not go back on a promise! By the time I turned 16, both my brother and sister had used our six year old Volkswagen as their car. By this time, my brother was working at Burger King after school and had purchased a new GTO. The Volkswagen wasn't much but it was all I expected. I drove it to school, to work, to after school events and on dates. That is until three friends and I rolled it over on the way to a football game.

We bent the fenders out, tied down the hood and managed to sputter all the way home. We had scrapes and bruises but none of us would go to the hospital even after Dad tried to convince each parent that a check up would be wise.

Dad knew I needed a car to take my brother and sister to school and to get to work so he continued to provide one. He bought another wrecked Volkswagen, cut the two of them in half and used epoxy to glue the two halves together. He personally rebuilt the motor and painted the body drab army green with a paint brush. It was not a pretty sight. I drove that car for the next several months.

At the time, I was probably embarrassed, just a little, to drive a beat up, hand panted, drab army green Volkswagen to school but I don't remember being embarrassed. At the ripe old age of 16, I was naive about a lot of things but I understood the lesson of the prodigal son. I went out and squandered my first car but my loving father spent his time and money rebuilding that old car for me.

Dad never ceased to amaze me. When the Volkswagen died again, he sold the frame, to a guy who wanted to build a dune buggy. He got enough money to buy the 1962 Ford Falcon that I drove for the next year and my sister drove for two years afterward. When my older brother was drafted, he left his 389 cubic inch, four in the floor, GTO at home. Dad and my brother trusted me to drive it! In a year, I had gone from the worst car as school to the best and life was good.

A short time later, my older sister married after her second year of college. Dad stuck by his promise. He wanted his children to be educated more than anything but he made a promise and he kept his promise. My sister's husband worked to pay for her education and then she worked to pay for his.

Without telling several more family stories, suffice it to say that Dad did not pay for all of any of his children's educations. We all married before we graduated and he kept his promise to us all; he paid until we were married but nothing afterwards. He taught us well, we all value education and we all have at least a four year college degree. His grandchildren have routinely finished undergraduate schools and several have or are working on graduate, MBA or Law degrees.

We all know in our hearts that God is Love. God gave us rules and freedom. We are free to do what is right or what is wrong. Dad understood and lived these concepts as well as anyone. He upheld his commitments to others, made rules for his children and he hoped and prayed that his children would live life well. On this Christmas Eve, I am thankful for "The Love of Dad". Mom is living alone after 60 years of marriage. I hope you will keep her in your thoughts and prayers.

I thank you all for reading this. I wish you all the best of Holidays, a Merry Christmas and a Happy New Year.

Posted by

Jack Miller

at

12/24/2004 02:08:00 PM

1 comments

![]()

YIELD CURVE STILL STEEP!

YIELD CURVE STILL STEEP! (click on image to enlarge)

Wow! Short rates up, long rates down and the yield curve is still very positive! The long bond current yield is 1.3 times the five year yield. The economy is slowing a little while stocks are remaining much more attractive than bonds! Very unusual! Very interesting! Very profitable!

Posted by

Jack Miller

at

12/24/2004 01:40:00 AM

0

comments

![]()

DON'T LOOK DOWN!

IS THE PRICE EARNINGS RATIO TOO HIGH? (click image to enlarge)

In Robert Shiller's book, Irrational Exuberance, the above chart accompanies data showing market returns were horrible for 15 to 20 years after major peaks in the PE ratio. For example, the S&P posted average real returns of -0.5% in the 15 years after the 1966 peak. At the end of this 15 year stretch, short interest rates had climbed to 21%.

I was fortunate to buy stocks in 1982 just after the rates started to fall. 1982 was the beginning of a fun time for the big S&P companies. However, the chart and data miss a very important point! Smaller stocks rose an average of 1500% (nominal returns) from 1974 to 1983 which was smack in the middle of the poor returns in the S&P! Those who jumped in near the top lost a bundle in just a few years. Many sold out at big losses by mid 1974. On the other hand, those who bought in '74 made big money right in the middle of this tough tough time.

While it is true that the market climbed a big mountain in the 90's, it is also true that the market took a big hit in 2000, 2001 and early 2002. The P/E ratio came down hard. The current PE is not high relative to bond rates. The rule of 20 demonstrates this point. Using the rule of 20 one subtracts the current yield of the 10 year treasury from 20 to get a fair PE ratio. This measure is simplistic but it works! The S&P is currently fairly valued and my guess is that earnings will grow by 9% in 2005. Nine percent returns are not incredible but they sure beat a 4% taxable bond rate.

Stocks look very attractive! However, if unexpected events should cause interest rates to rise sharply along the curve, my tune would change quickly. The view is beautiful from here; just don't look down!

Posted by

Jack Miller

at

12/24/2004 01:06:00 AM

0

comments

![]()

Wednesday, December 22, 2004

THE PRISONERS DILEMMA, TIT FOR TAT or CHICKEN

I love to play games and it seems that Reed Hastings of Netflix is ready and willing to play serious games. Today my worse performing stock was NFLX. The stock dropped 7% on the news that Blockbuster has lowered its subscription price by $2.50 to $14.99 per month.

Wal-Mart was already running a $15 special with a maximum of two movies out at a time. BBI just beat the NFLX price by $3 per month and Wal-Mart with an extra movie out. For BBI to beat NFLX on price is not necessarily smart but to beat the Wal-Mart prices appears to be suicide. BBI advertises 30,000 titles, unlimited rentals and no late fees. They promise to build several distribution centers in order to match NFLX with next day deliveries.

Back in my college days, I was required to participate in "lab games" in the psychology department. All participants received course credits and we were paid an average of $3 per hour. Participants were paid on how well they played games designed by the professors and graduate students. In one three hour session, I was one of twelve participants. We all knew that we would split $108 among the 12 depending on our game skills. One fellow did really well and earned more than $9 leaving less than $99 for the rest of us. I earned $97.40 and the other players split $1.50 ten ways. Yes, I am bragging to demonstrate that there are big winners and big losers in business.

The games we played included Prisoners Dilemma, Tit for Tat and Chicken. In each of these games, the players needed to listen carefully to the rules. To be successful one typically needed to take advantage of the rules. To win, one should break the rules if the penalty for breaking a rule is low or if the probability of getting caught is low. Yes, the games were purposely designed to make each player examine the ethics of the situation and decide what is the right thing to do.

The game of life is about the same. We are called by our "moral compass" to understand the rules and play by the rules. The concept to be learned in Tit for Tat is that a business cannot make money if it participates in a price war. Unfortunately there are times when a price war is hard to avoid. Several airlines are bankrupt or close to bankruptcy as a result of players who are willing to try to steal market share by fighting a price war. Several well run airlines have just been through an all out game of Chicken.

So far, NFLX and Reed Hastings have played a good game of Tit for Tat with Wal-Mart and with Blockbuster. The winners in the game of Tit for Tat are usually those who do not try to have the lowest price.

I have watched a regional operator of convenience stores play Tit for Tat for many years. He is very successful and he keeps growing the business. Every now and then he is forced into the game. Let's say that he is selling gas for $1.75 per gallon when the store on the opposite corner unexpectedly lowers its price to $1.67. He knows $1.67 is not enough to give a fair return but he also knows that if he continues to charge $1.75 he will not sell much gas.

The vindictive player might lower the price to $1.62 and the next thing you know the other store would be at $1.52 and so on. Pretty soon both stores would be losing lots of money. Their game would become a game of Chicken. Each would desire to last longer than the other knowing that the survivor can re-price for bigger profits. The problem is that even if you win there might be a third owner down the street that knows you are weak from the battle. The cycle may start afresh and the truth is that even the customers are eventually hurt by a price war.

The smart player lowers the price to exactly $1.67 or maybe just a penny or two more at $1.68 or $1.69. Most customers will not cross the street to save a penny or two. As an alternative, the smart player may lower to exactly $1.67 for a few days and then raise the price a penny or two a few days later. The point is to send several signals. "You get no more business at the lower price because I will match you". "You and I both will sell about the same amount of gas at $1.67 or at $1.75 why not make the extra $.08. "There is enough business for both of us if we keep the price up".

When it was clear that BBI and AMZN were about ready to enter the business, Reed Hastings raised the price at NFLX by $3 per month. He let the players know that he does not want a bloody price war. When BBI jumped in at $17.49, Hastings lowered the NFLX price to $17.99; and excellent Tit for Tat move. BBI, apparently out to win at all cost or seeing the hand writing on the wall for its brick and mortar business, then threw-in two free in store movies per month.

Hastings did not reply directly but did adjust. NFLX had previously stated plans to enter the European market. NFLX withdrew those plans to stay focused on the now competitive US market. In effect, NFLX said, we are going to stay strong here in the states. You can lower the price but you can't run us out of business. More importantly, the move was a signal to AMZN and sure enough, AMZN made the smart move of starting their movie rental service in the European market only.

Today, Hastings said that NFLX has no plans to meet the $14.99 price. Clearly the plan is to continue to offer the best service. NFLX is David going up against the Goliath, Blockbuster. NFLX is trying to be smart and Blockbuster is going after a flea with a sledge hammer.

It is interesting that Blockbuster has 8,900 stores, $6 Billion in sales and a slow delivery service while NFLX has zero stores, $500 million in sales and a fast delivery system. Blockbuster's sales growth has been stagnate while NFLX has gone from $81 million to $500 million in 4 years.

Anyone who has cell phone service has probably been on more than one carrier and has experienced dropped calls and poor service. The services of all the remaining players is far better now than in prior years. Nextel did not have the backing of an established large phone company but it has survived and prospered by giving the best service. It has the lowest churn rate, the highest usage per customer and it consistently gets more than its pro-rata share of new customers. The public has paid a higher price to get the best service.

My projection is that NFLX will not survive as a separate company. Hastings is playing the game well and he has the skill to successfully battle Blockbuster, but Wal-Mart nor AMZN are going to go away. The cable companies nor the studios are ready to surrender prime content to be sent via the internet. TIVO and NFLX will offer an electronic delivery program but it is not likely that they will do it as independent companies. One would assume that one of the owners of the large movie collections would be the company to buy TIVO and NFLX. TIVO seems to be the more important piece.

AMZN has about the same sales as BBI but is growing its sales rapidly. AMZN is gearing up in Europe but eventually they will bring the service to the states. Will they buy NFLX? I would not be surprised.

Put BBI up against Wal-Mart and AMZN and one must wonder about the break up value of BBI. Hastings said yesterday that the latest pricing by BBI kills the video store! The store is committing cannibalism. BBI says half of their new subscribers have not been into a BBI store for six months. That means the other half may stop coming to the store. It may be that BBI will rapidly convert to the NFLX format and then offer the real estate for sale.

Based on the BBI bid to buy Hollywood Video, BBI believes it can operate the brick and mortar stores for some time to come. Clearly there are many customers who do not pay $15 every month for movies. If the majority of the active renters subscribe to on-line services, can the store be justified for the large numbers of infrequent renters.

Perhaps it is foolish to own a company that is operating a business model that will die in maybe five years. My brain tells me it is wise to bale out now. My heart is with NFLX. The company developed an innovative plan that would have eventually killed the video store as a business model. The company has discussed with TIVO a plan that would benefit the consumer. I believe the announcement of an on-line delivery service will be made soon. Surely TIVO and NFLX understand that the take over price would be significant if they could at least get an internet movie and TV service up and running.

The biggest remaining question is will the movie moguls allow movies to be transmitted over the internet by independent companies in exchange for a license fee? Time Warner and others have big decisions to make. The music business was destroyed when the players did not appreciate the power of the internet.

GOOG has apparently thought the situation all the way through for printed content. GOOG has stated that on-line libraries will be good for the Authors, Publishers, Libraries and Patrons. John Malone is playing hard-ball with News Corp to pry free TV-Guide as another piece of the media server dilemma. The efficiency of on-line delivery should create the same win-win situation in the movie business as seems to be developing for libraries. Until then, how about a game of Chicken?

Posted by

Jack Miller

at

12/22/2004 10:19:00 PM

0

comments

![]()

12/22/04 ANOTHER GREAT MARKET DAY!

My criteria for a great day is "up 1% or more on assets". For many years, I read the "Prudent Speculator". It was a good letter with a good track record. Hulbert and others would take its ratings down a notch by making risk adjustments. The adjustments were possibly unfair in a couple of ways. Knowing when to use leverage requires knowledge and mental toughness and those who use leverage often do so against bigger, safer securities.

My favorite investment after ocean front beach property is US Treasury Bonds. However, I only buy Treasury Bonds when I believe long interest rates are too high! When I buy bonds, I buy them on margin. OH MY! LIONS AND TIGERS AND BEARS! Treasury bonds are backed by the full faith and credit of the US Government. How can anyone who has ever bought a house have a negative attitude about a person who uses bonds for collateral?

Often times I will review an investors accounts and find what initially appears to be a risk averse posture; loads of cash and short term notes. Then the stock portion turns out to be 50% or more in his company stock and another 25% in high flying "news-making" stocks. Finally it is amazing how many investors are holding on-to a mixture of losing positions waiting for redemption day. Mention margin to this guy and he is apt to join the chorus; OH MY! LIONS AND TIGERS AND BEARS!

I admit to being aggressive. I heavily over-weight sectors and buy on margin in certain family accounts. I buy and hold too many stocks but typically own more than one or two stocks in the same sector. Today was one of those great days. The assets went up more than 1% in value and the return on equity went up by about 2%. A 500% annualized rate.

A few days ago, I enjoyed several days when my top three positions were my top three gainers. Those were fun days. Today was different. My top 7 gainers were all stocks that were purchased in the past few weeks. Five of these were new positions. Two were old positions to which I added shares (average up often--average down seldom).

My top seven today were CAL, RNWK, PFE, DAL, ET, T and LVLT. Clearly CAL and DAL were bumped by the lower oil price but data suggest that revenue seat miles have finally turned, costs have been reduced and the risk of bankruptcy has been reduced. RNWK received the good news that Microsoft lost the Euro anti-trust case. PFE has bounced 12% in three days. One rarely gets the chance to buy a super stock at a discount to the market. Forget the bad news and buy the stock. ET is the leading money making discount broker, on-line mortgagor, integrated banker, internet stock. It will benefit and suffer from trading peaks and valleys but will prosper. My family has owned T all my life but I bought more recently. I also bought a few shares of Level Three recently. The volume of voice, data and video to be sent over telephone lines in the next several years is truly incredible. T and LVLT have the capacity in place to "haul the freight".

The best buys in the market are when you know something that others have heard but that they do not believe. The average person in the US has heard about picture phones, pocket computers, music down-loads and more. However, the average person does not really know or believe. Pocket communicating computers are about to change our way of living. In a few years, many people will do many things by pocket computer and wonder how they ever got along without them.

The majority of consumers may not have heard of VOIP or SKYPE. However, I know, without a doubt in my mind, that most consumers will send and receive volumes of voice mails, video voice mails, streaming video, music videos, sports shows and more over LVLT or T lines. I know that I can't even imagine half of the ways these devices will be used but I know they will be used.

LVLT is a high risk security. The company is currently spending more cash than it receives. This letter is written for the entertainment of the author and his readers. The author is an amateur private investor. Readers should do their own research or seek the advice of qualified professionals prior to investing in securities.

Posted by

Jack Miller

at

12/22/2004 08:59:00 PM

0

comments

![]()

EURO RALLY AND STOCK RALLY TO CONTINUE!

The pundits continue to cry with alarm that the dollar continues to fall! GOOD!

The rally of stocks has paralleled the rally of the Euro. The pundits are probably right; the dollar will go lower. Just don't let this reality cause you to avoid stocks!

By the way, long rates and the dollar trend together. This fact is counter intuitive. It leads many to see data and draw the wrong conclusions. For two and a half years I have been a bond bear and a stock bull. This has been the profitable allocation. Not that bond returns have been negative but because stock returns have been sweet.

I expect 2005 to be another good year for stocks. However, I expect a powerful sector rotation to continue. As always, it will be important to be in the right stocks.

Fortunately or unfortunately the investment puzzle is more complicated than it looks. In every sector, there are opposites. In the soft drink market you have the companies that sell the syrup and the companies that buy and bottle the syrup. In the last week or two, KO and PEP have broken-up while CCE and PBG have broken-down. Health care includes companies that buy drugs (hospitals and other providers) and companies that sell drugs. Some financial companies lend big dollars to businesses and others borrow big money to buy businesses.

Picking the right stocks in the right sectors will be key to making big bucks in 2005. I hope you will rely on my "rules". These include, zigging when the popular press says to zag, keeping your transaction costs and fees low, putting no more than 7% of your funds into any one stock and be willing to ask for help or a second opinion. A good discount broker such as Brown, ET or AMTD will save significant brokerage fees.

Posted by

Jack Miller

at

12/22/2004 08:21:00 PM

0

comments

![]()

SANTA CLAUS BREAKS OUT!

When asked if I invest based on fundamentals or technicals, I respond that I invest by the seat of my pants. The old rule rules; if it works don't fix it!

Yesterday, the Dow broke out and this morning the oil inventory build was larger than expected. I bought some more ETrade on margin. It looks like the proverbial Santa Claus rally is well under-way. Oil is down $1.80 and all major stock indexes have reacted.

For good measure and just for the entertainment value, I purchased call options on the QQQQ this morning.

Caution! I am an amateur investor and do not recommend investments. This blog is written for informational, educational and entertainment purposes. I certainly do not recommend options as investments. On balance, I have enjoyed success in stocks, bonds and real estate investments. I occasionally buy puts or calls on the indexes but I do not expect to make money. Where the QQQQ will trade in the next few weeks is a pure guess.

Having said the above, I find that there is healthy skepticism in the market. The unbridled optimism that happens at the end of a long bull move is not present. Market mavens continue to discuss the potential problems to be faced in the New Year. At best, the expectations are for moderate 2005 returns.

Posted by

Jack Miller

at

12/22/2004 10:42:00 AM

0

comments

![]()

GOBBLE! GOBBLE! GOBBLE!

Mega merger and acquisitions have not slowed a bit. It is a global phenomena. HSBC is bidding 2.5 Billion for Korea First Bank. Every industry is consolidating. Cisco just made its 12th 2004 purchase!

At a time when the public thinks stocks are over-priced, companies are buying other companies stocks or their own stocks. Stocks on average are cheap. The excitement is not over. Not when companies like DELL and GOOG are each sitting on $2 Billion in cash.

Should GOOG decide to buy a big player, it has cash and stock to offer. It can buy just about anything it wants. The good news for GOOG holders is that the company is growing so fast it does not need to buy anyone. Companies continue to raise dividends, buy back stock or buy other companies. Smart investors should beat them to the purchase.

A common argument against buying stocks now is that insiders are selling. The charts of insider selling show that the current situation is similar to what happened after the 1982 recession. The market took off and insider selling reached record levels. After a prolonged tough market, everyone stuck in stocks purchased before the crash are eager to cash-in. NASDAQ stocks in particular went too high befor the bubble popped and then went too low afterwards. Most of them have much higher earnings now that 5 years ago but sell for much lower prices.

Ooops! I spoke too quickly.

A few days back, I said to avoid foreign stocks and invest in good old "big, dumb and ugly" American companies. Part of my rational was the contrary indicator that the American public is transferring retirement funds to international stock funds. I also suggested that you use the Business Week article about Brazil and other developing nations as a contrary indicator.

I stand by the main points but must correct for Germany, Japan and other developed countries. The sentiment is very negative in these countries and investors are very risk averse. Stocks are still cheap. These markets trade much more in line with ours now-a-days so the diversification benefits are not great. Never-the-less, if you want foreign funds, buy EWJ or EWG. These exchange traded funds give you foreign holdings for a very small expense ratio.

Germany is finally doing something about its overly generous unemployment benefit program. East Germans are still having trouble accepting the capitalist idea that you have to work to earn a living. The laws in place for the past decade have paid high unemployment benefits to German workers for years of leisure. Laws inacted to reduce the benefits will take effect in 2005.

Forecasts Rise!

Professional stock gurus are increasing estimates for next year. The rational is typically that the new social security program could put up to 100 Billion Dollars per year into the stock market. I find this is the type of idea that one should front-run. The market will rise in anticipation of the money coming. If you wait to invest after the law has passed, you will have missed most if not all of the move.

Trade Deficit Misunderstood!

If the trade deficit were only a factor of strength or weakness in the dollar, how is it that the US Dollar is weak and the Aussi Dollar is strong but both countries are running huge trade deficits? We read about the strength of the Euro and the British Pound all the time but England runs a trade deficit that is proportional to the US deficit.

The answer lies in the free trade all three countries have with China and other developing nations. It is only common sense to buy goods made by workers making $.65 per hour versus those making $21 per hour. The deal is a good deal for the buyer and the seller. The standard of living for an average person in China has improved dramatically in the past 10 years. The deal is specially good for the buyer when the seller reinvests the money with the seller.

It is smart for the orange grower to trade with the wheat grower and smart for us to buy socks made in China. Americans who lose their jobs are typically sad for only a short time. America is a job machine. We have the best jobs of any nation and year after year we create more and better jobs. We can afford to pay more because we buy cheap socks from China. Don't fight what is good; embrace it; invest wisely; make lots of money and help your neighbor.

Posted by

Jack Miller

at

12/22/2004 02:03:00 AM

0

comments

![]()

Tuesday, December 21, 2004

SELL WB? HOLD GOOG, YAHO, TWX, AMZN, EBAY!

In three earlier posts this morning, I showed that WB is not my favorite stock. Further investigation would show that WB is a conservative bank and is not nearly as levered to the yield curve as many banks. Without looking at any financial data, I am confident that most of WB's loans are floating rate loans tied to short interest rates or that the durations are on average short-term. Conservative banks have worked for twenty years or more to earn less from spreads and more from fees. I simply pick on WB because it is a favorite of quite a few of my regular readers.

One might ask, How can you suggest the sale of WB while holding so many "over-valued" internet stocks? Yes, after the addition of more shares at $171 and the latest move, GOOG is one of my top three positions and EBAY and YAHO are in my top ten. Even AMZN has been very good to me. I have a nice profit in TWX but it may be the only "value" play of the bunch.

The answer is that I believe the numbers posted by Bambi Fancisco of CBS.MarketWatch.com. Here are her key points:

1. Keyword advertising is expected to grow at compounded rates of better than 20% to over $19 Billion in 4 years. GOOG and YAHO will get the biggest portions.

2. On-line shopping appears to have risen by more than 30% again this year. AMZN and all the others listed will benefit. The market mavens who have been negative toward AMZN have talked about the slowing of on-line shopping. Bah-Hum-Bug! Those who study the second and third derivatives sometimes out-smart themselves. On-line shopping will grow faster than brick and mortar shopping for many years to come. The rate of growth will naturally decline but so what! Only fools try to pop in and out of these fast growing companies.

3. Only 3% of total advertising is on-line advertising. Wow! The irony is that the growth is slowed by the efficiency of the advertising. Ads are delivered primarily to those who are interested in that particular ad. Think for a moment of how many new pages will be available for advertising as whole libraries come on-line. The beauty is that folks do not mind advertising that is non-obtrusive and relevant to their lives. Those who read books about pets want to know about special deals offered by the local pet shops or about shows or whatever. Those who read investment books want to click on a link to find this blog.

A firm that measures web ad effectiveness is Net Ratings. The chairman was a guest on Kudlow and Kramer recently. It is clear that a firm like Net Ratings can help target ads to the exact audience. I have not studied the stock but my gut feeling is that I should be an investor.

In the same piece, Fancisco expressed concerns about high valuations. One example she cited was the purchase of rent.com by EBAY for 10 times revenues. I too am concerned that EBAY may have over-paid. We know EBAY is good at auctions and at on-line payments. We owners do not need for EBAY to have a third front but if there is a solid profitable business to be built then go for it. One blogger says investors should buy Homestore.com. He says that if Rent.com is worth 10 times revenues then surely HOMS is worth more than 2 times revenues. NOT FOR ME!

I try to avoid buying shares in companies that are facing direct competition from the biggest bear in the woods. I don't care if IACI "might" buy HOMS because they "might not". (I recently sold my CC partly because Best Buy is the grizzly bear of tech retail.)