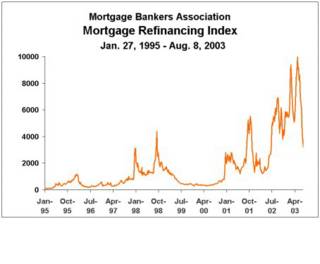

WHAT FEES? WHERE DID THE BANKS FEES GO? (click graph to enlarge)

A reader response to my comments on banks makes the above graph worth posting. My points still stand. Home owners refinanced and refinanced when rates were going down, banks took in fee after fee, but the game is in double overtime. Many of those refinancings were for fixed long-term mortgages and the banks are now stuck with low income loans. The fees are falling and will continue to fall if rates rise. They will fall even more if housing prices stall. Delinquency will rise if rates rise. Consumers with variable loans are already noticing increases.

Please compare the above chart to the chart below of Wachovia Bank. As you can see, the last big peak in refinancing was in 1998. It took Wachovia another year to hit the peak and then it was all down hill. I suspect the reaction may be faster this time and indeed if you compare the WB chart below to the chart of TYX above you can see that we are at the same high-low that we made in 1999.

The refinancing peak just passed was a big because rates fooled homeowners into refinancing the second and third time as rates continued to fall. Another thing to note is that WB did well in the second phase of the recovery last cycle but most of the entire time was a time of falling long rates. WB will not have an equally strong tail wind this time around.

Consumer staple stocks are at four year lows relative to consumer durables and many of the companies have been raising dividends. Companies such as Colgate are cutting cost while selling even more toothpaste. Consumers buy toothpaste when interest rates go up, down or sideways. The cost of a financed car goes up substantially when interest rates rise (hidden cost or not). Buy consumer staples (food, beverages and socks) and avoid buying stocks that depend on financing or re-financing (lows, banks, cars, and housing). Housing stocks are at low price to earnings ratios and may go up more but they are nearing the end of a very long run; avoid.

The index of consumer discretionary stocks includes cable TV and fast foods. I am not so sure about these. It seems to me that cable TV especially to those with VOIP phones and computers are now necessities and that one can almost always afford a happy meal. Some folks would also avoid computer companies such as DELL in a rising rate market. Not me! I believe consumers will soon replace existing computers with big screen machines with extra features. Reading books and magazines on line is pleasant if you have a super sized screen. TV cards will become standard equipment. Price conscious consumers will choose DELL.

Tuesday, December 21, 2004

WHAT FEES? WHERE DID THE BANK FEES GO?

Posted by

Jack Miller

at

12/21/2004 01:44:00 AM

![]()

Subscribe to:

Post Comments (Atom)

0 comments:

Post a Comment