I spent several hours Saturday and early this morning studying the markets. I want to share my two basic conclusions:

1) Fundamentally most big stocks are still cheap relative to other investments;

2) The reactions of investors to recent sharp declines shows that the current correction is not going to become much worse.

Sentiment has made a rapid turn. There was a lot of greed built into the market just a few weeks ago but now fear is taking over as the predominant motivator.

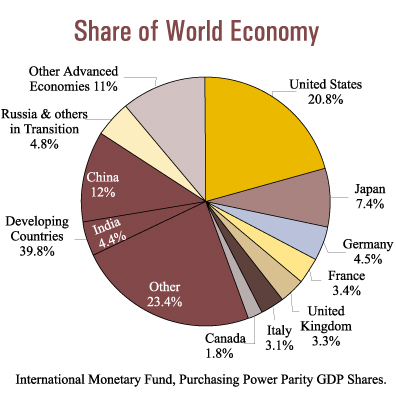

I have personally been very concerned about the flat yield curve, the sharp decline in housing prices, the decline in car sales and the sharp decline in consumer confidence. However, this morning, I reviewed charts of the weighted average world yield curve and was pleased to see positive prospects for a strong world wide economy.

In regard to my favorite group, a report from San Francisco shows that airfares will be up an average of $30 in June, $40 in July and $50 in August; very strong. The August number is extremely strong because in most years fares trail off by the end of summer. To reach an average increase of $40, with the $400 tickets up only about $25, the $59 seats have had to double. There are still bargain seats around but fewer and fewer of them. One of the ways the airlines can hide a price increase is by leaving a $59 special on the books but reducing the number of seats that are available at that price. This practice encourages passengers to book early which allows the airline to adjust to the market and attain higher yields.

Some of the other areas that have become attractively priced includes bio tech, internet, commercial real estate and selected telecommunications and technology stocks. The super conservative investor could buy AT&T and get a yield of better than 5%. Not bad but because I see free or almost free internet phone services around the corner, I will invest in areas with higher growth potential.

Tuesday, May 23, 2006

TWO MARKET CONCLUSIONS

Posted by

Jack Miller

at

5/23/2006 01:18:00 PM

![]()

Subscribe to:

Post Comments (Atom)

0 comments:

Post a Comment