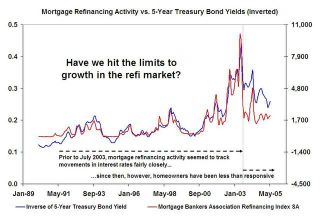

Home Refinance (Our thanks to Barry Ritholtz, thebigpicture.com, for this chart from the Mortgage Bankers Association) (click picture to enlarge)

When the 5 year treasury rate dropped like a stone in early 2003, consumers could not refinance fast enough. The above chart suggests that consumers have locked into low rate home mortgages. It takes more than a small decline to budge the graph. The picture helps explain the incredibly strong consumer spending of recent years. Those who dropped their mortgage payments by a few hundred dollars are spending some or all of the savings.

The past few days, the evidence has been consistent with Greenspan's testimony yesterday that we are over the soft patch. At least one of the "big houses" now projects accelerating nominal GNP--to 7%! The problem is this same house projects a year end fed funds rate of 4.25 and a ten year rate of 5.25. In effect, the projection is that inflation, interest rates and the economy are going to heat up. Consistent with the concerns of the past few years, the market will again fear inflation rather than recession. Worried people just do not appreciate how good life is.

Greenspan mentioned pricing power. Again this is consistent with the recent strength in semi conductors. Indeed the reflation theme is flowing through the markets, for example, oil drillers are making a nice run.

I remain a BULL. Increasing corporate earnings and cash flows are sitting in a pressure cooker; the pot is getting hot! The average S&P 500 company has increased its cash hoard from 6% of assets to 11% of assets. The average debt to equity has declined from 80% to 64% (statistics courtesy of Morgan Stanley). Again, the Sun Micro purchase was illustrative. The company used $4 billion of its $7 billion in cash and ended up with $4 billion left over. The acquired company just happened to have an extra billion dollars of cash laying around.

My nickname, T-Bond, came about during the mid 1980's when T-Boone Pickens was doing leveraged buy outs. Some said that I tried to buy all the entire US Government debt on margin. I borrowed money at 13% to buy 30 year bonds yielding 13.75%. The bonds appreciated about 60% over the next two years! Morgan Stanley reminds us that corporations are so cash rich that the T-Boone days may come back.

The bottom line is that consumers and businesses have excess liquidity. If there were a shortage of goods to purchase, this excess liquidity would be very inflationary. However, the boomers having purchased SUV's and second homes still have cash and buying power.

Real estate has inflated, commodities have inflated, total income has inflated; it is now time for stock prices to inflate. Companies and consumers have the cash to buy stocks. The race has started; who will own xyz company when abc company announces a take-over bid? Look for stock buy backs, mergers and increased dividends. Leaving mountains of cash on a corporate balance sheet is an invitation for a CEO to lose his job! Corporate raiders seek cash rich and asset rich companies to buy. T-Boone and others used the target companies assets for the loans to buy the company. The assets were often sold piece-meal with the raider keeping the excess proceeds as pure profit. Day by day bids are being made and mergers are being announced. Are you getting your share?

BUY THE BIG BULL--IT MAY REST AWHILE BUT WHEN IT MOVES IT WILL BE A STAMPEDE!

Friday, June 10, 2005

HOME REFINANCING DONE? WHAT IS NEXT?

Posted by

Jack Miller

at

6/10/2005 10:27:00 AM

![]()

Subscribe to:

Post Comments (Atom)

0 comments:

Post a Comment